The Refugee Zakat Fund

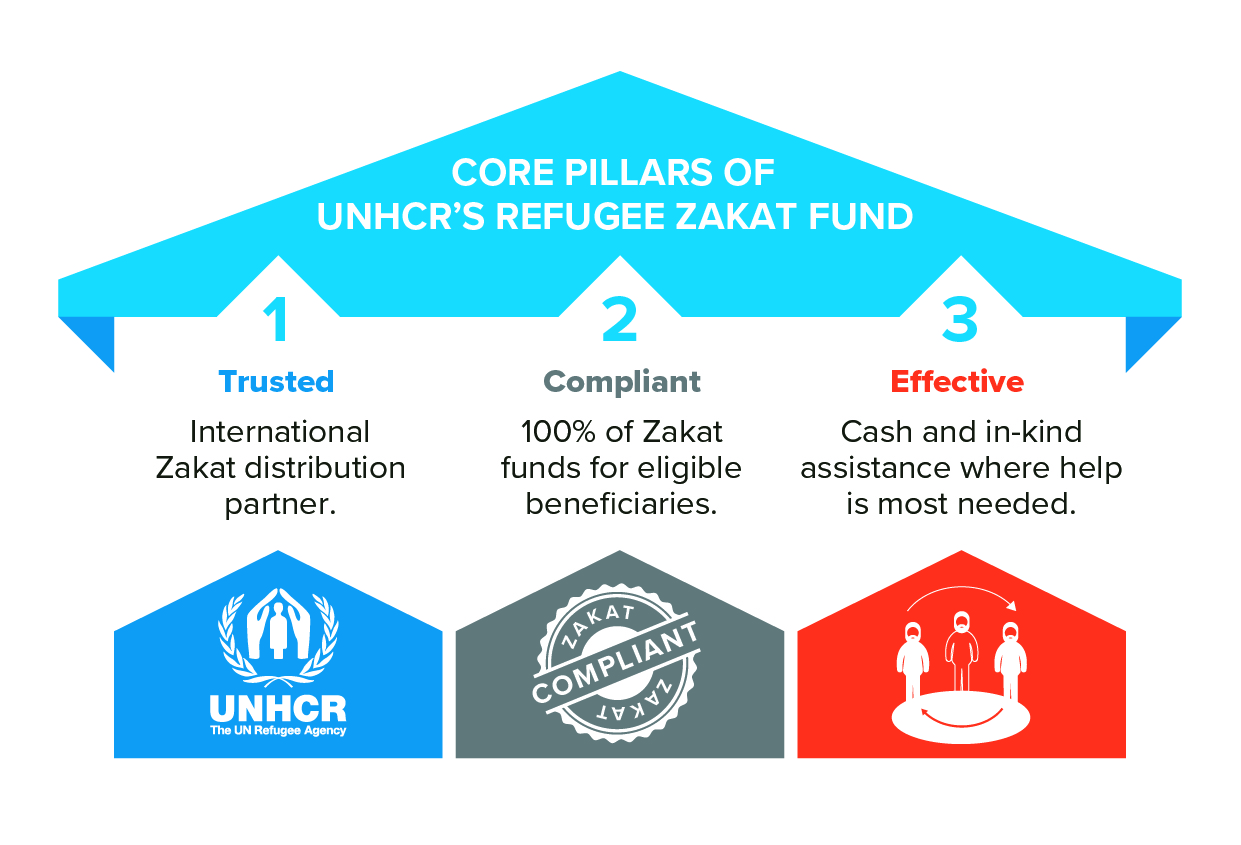

Trusted. Compliant. Effective.

Trusted. Compliant. Effective.

With the rapid growth of the global Islamic economy and philanthropy sector, and given the increasing desire by Zakat donors and institutions to channel Zakat funds to refugees – more than 50% of whom are originating from Organization of Islamic Cooperation (OIC) countries – UNHCR launched in 2019 the “Refugee Zakat Fund”: a trusted, compliant and effective distributor maximizing the impact of Zakat and Sadaqah on the lives of refugees. Since its piloting in 2017, over 8 million beneficiaries have been assisted with Zakat and Sadaqah through the Refugee Zakat Fund.

How do beneficiaries receive your Zakat?

Beneficiaries of the Refugee Zakat Fund receive assistance either in cash or in the form of goods, in accordance with Zakat compliance requirements.

What is the governance of the Fund?

UNHCR’s Refugee Zakat Fund is subject to rigorous governance and oversight, ensuring transparency at every step, leading to the provision of assistance.

Management and accountability: Zakat funds are kept in a dedicated interest-free bank account in Geneva.

Traceability: Zakat funds are strictly dedicated to Zakat-compliant distribution activities of cash and goods in identified countries with growing humanitarian needs.

Transparency: UNHCR publishes two Islamic Philanthropy reports per year, and partners are provided with customized reports based on where they wanted their funds to be utilized.

Fatwas: the Fund is endorsed by 17 fatwas from prominent scholars and institutions globally, including the Muslim World League, OIC’s International Islamic Fiqh Academy (IIFA) and Al-Azhar’s Islamic Research Academy.

Infrastructure: follows a 100% Zakat-distribution policy to eligible beneficiaries as recommended by the fatwas.

Monitoring and evaluation: annual internal compliance review is conducted by an expert Islamic Philanthropy team in UNHCR, and an annual external compliance review is conducted by a third party which publishes a report about the findings of this review, which is available on the reports page.

Vulnerability assessment framework: to identify eligible beneficiaries. Post-distribution monitoring: annually to measure impact and improve implementation.

Innovation: use of technology in distribution to increase efficiency and minimize fraud and duplication.